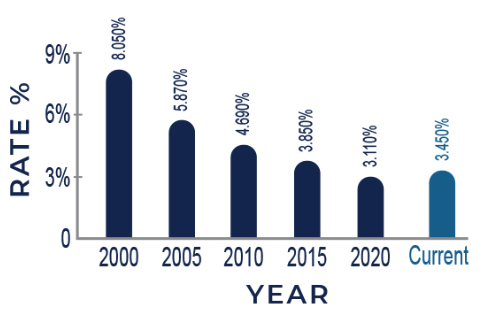

Mortgage industry experts anticipate at least two more increases this year. It’s important to keep in mind that rates are still historically low. Your monthly mortgage payment typically comprises mortgage, interest, and escrow payments. And what on the surface may look like a small increase in your interest rate, can have a big impact on your bottom line. So it’s important to compare mortgage lenders to ensure you’re getting the best deal. Over a 30-year term, a 0.5% rate increase on a $250,000 loan balance could cost $68 more a month: $1,054/mo vs $1,122/mo.

MORTGAGE INTEREST RATES ARE STILL AT HISTORICALLY LOW LEVELS.

210 Realty Group - Tuesday, January 25, 2022