The Federal Reserve issued its sharpest increase in interest rates in two decades on Wednesday, part of its aggressive campaign to curb inflation.

In years past, these interest rate hikes may have slammed the brakes on a runaway housing market, but soaring home prices in San Antonio and across the country may take months or even longer to taper out because of a more fundamental dynamic.

“We’ve just run out of homes to sell,” said Adam Perdue, a research economist with the Texas A&M Real Estate Research Center. He and other experts expect home prices to slow their furious ascent — but not fall — as demand winds down and supply catches up.

Exactly when that rebalancing happens is anyone’s guess, Perdue said, because these kind of market conditions are unprecedented. “I can’t tell you if that dynamic works itself out in two weeks, two months or two years.”

He and other observers expect price appreciation to slow at least somewhat by the end of the year, and flatten sometime next year, thanks in part to the interest rate hikes.

In the meantime, the local San Antonio market remains red-hot. In March, the San Antonio Board of Realtors reported the median home price in the San Antonio-New Braunfels metropolitan area had risen to $326,500, a 22% jump from the year before.

The volume of sales appears to be slowing, though results are still mixed. The volume of Bexar County home sales fell 3.2% from March 2021, the biggest drop in months. However the San Antonio-New Braunfels and statewide sales volume grew by a percentage point or less over March 2021.

Inventory remains at around 1.1 months of supply statewide — the number of months it would take to sell all properties currently for sale at the average monthly sales pace — as they have since the beginning of the year. The amount is far below the roughly six months worth of inventory normally held.

April numbers released in the coming weeks could show a more dramatic picture, though the entirety of the year’s projected interest rate hikes have already been locked into mortgage rates for weeks. The average 30-year fixed mortgage rate has risen from 3.11% to 5.1% over the last two months.

Nationally, new home sales were down 12.6 percent in March compared with March 2021, according to the Census Bureau. Existing homes sales were down by 4.5%, and pending sales dropped 8.2%, according to the National Association of Realtors.

“The reason sales are shrinking is because there’s nothing to sell,” said Maynard “Doc” Stephens, a real estate agent with Keller Williams. “People are afraid to sell because, where would they go?” Would-be sellers would also be buyers, and as buyers they would have to contend with other bidders, many of whom put forward cash offers well above the listing price of a property.

But while the supply is unlikely to rise dramatically any time soon, the cheap financing partly driving the ongoing boom will soon be coming to an end.

The Federal Reserve is on an aggressive campaign to curb soaring inflation by raising interest rates — driving higher rates on everything from credit cards to mortgages. The first increase came last month, and Wednesday delivered another half-point increase. Many more are expected through the end of the year as the rate lands around 2.25-2.50%.

Until last month, the Fed held the interest rate at nearly zero, where it had hovered for two years. That historically low rate had made borrowing dirt cheap, and was intended to encourage spending and investments to help lift the economy out of pandemic-induced recession.

It also helped usher in a housing boom, as first-time buyers and corporate investors alike took advantage of cheap financing and rushed the market, often resulting in bidding wars that carried sale prices far above their listing price.

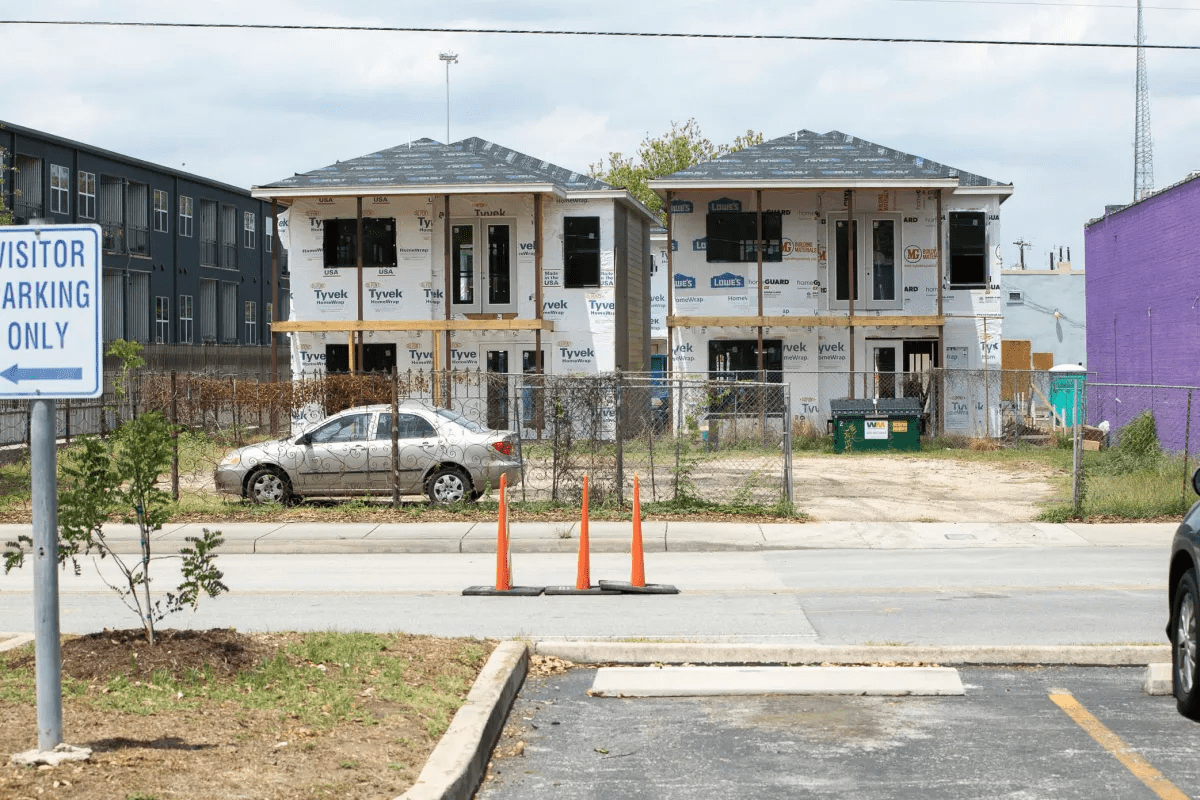

The new demand slammed a housing market already marked by anemic supply. Production of new single-family homes plummeted in the 2000s and remains at about half that of the preceding four decades. Construction continues to be constricted by pandemic-era material shortages and supply chain delays.

“When rates fell so much, people bought big and new houses,” said Perdue. “And then we ran out of big and new houses. People are now buying smaller and older houses.”

Moody’s Analytics studied the housing markets of nearly 400 metropolitan areas in the country, and found 96% to be “overvalued.” Homes in the San Antonio-New Braunfels area were found to be around 25% overvalued.

But those waiting for housing prices to fall from inflated highs may be in for a rude surprise. Moody’s expects only the highest-inflated markets — like Boise, Idaho, where home prices are 73% above what fundamentals support — to see price decreases. Everywhere else, the demand is too high and the supply too short for prices to drop.